{6 minutes to read} The doors are now open to the 2023 tax season, with the IRS extending a little empathy toward certain losses. Are you an investor and a victim of a possible investment scam such as a Ponzi scheme? The IRS may allow a deduction for that.

But before we get into the article, last month, we paused to honor a man who was tuned into humanity. We remembered Dr. Martin Luther King, Jr. who contributed to the better good of mankind. He is known for his nonviolent resistance approach to achieving social change for humanity.

This month, we bring awareness to our health. The National Health Observances (NHOs) has highlighted some special days this month to raise awareness about various health topics; one of which is our heart health. Our physical health is an integral part of our overall well-being. In the following link, you may find something useful National Health Observances.

Note, some of you may have received the previous email — some of the content below was a part of that email article, however, it may be worth reading again.

Moving along, don’t forget the below:

- Maintain adequate records —This has been in the news since last year, and the IRS has “more hands on deck.” So, to minimize tax reviews/audits, consider maintaining adequate records of your income and expenses (i.e., actual receipts, not just credit card receipts).

- Gather the necessary documentation if you are claiming any type of credit for 2023, a few are related to your home, or vehicle, among others.

In this article, we will discuss theft loss and highlight a few changes in the SECURE Act – mainly retirement savings.

Theft Losses

The IRS may allow certain investment losses to be deducted as “theft” losses. Are you an investor and a victim of a possible investment scam known as a Ponzi scheme?

Do the names Bernie Madoff and Sam Bankman-Fried (SB) ring a bell? Wikipedia.com labeled them as fraudsters and suspected fraudsters, respectively. Bankman-Fried, the founder of FTX, is currently being investigated for allegations that he misappropriated customer assets. Madoff was criminally charged and labeled as the mastermind of one of the largest Ponzi schemes in US history.

The actions of such individuals have caused significant financial distress in the lives of many. If you have been defrauded, the IRS empathizes with you, and extends a “safe harbor rule,” allowing you to deduct the investment loss by treating it as a “theft” rather than a capital loss. Under the current tax rules, an investment loss is generally limited to $3,000 per year.

There are various criteria to meet for the loss to be a “qualified” theft loss. One is, the loss is from a “specified fraudulent arrangement,” and the accused was charged by indictment with the commission of fraud, embezzlement, or a similar crime under state or federal law. If qualified, the theft loss may be deductible in the year the fraud is discovered. The loss is also subject to a certain limitation of adjusted gross income and applies only to the loss suffered. If the loss is reduced by a claim (paid), the unrecovered amount is deductible.

As of the date of this article, it is not clear if the actions of Sam Bankman-Fried meet the requirements to be classified as a “theft” loss.

The SECURE Act

Changes to the SECURE Act were signed into law by President Biden on December 29, 2022. In a nutshell, the law requires employers to offer retirement plans to certain individuals and also gives us more flexibility in saving for retirement. The Act is rather extensive, however, here are a just few changes in the provisions:

- RMD distribution – Effective January 1, 2023, the age at which retirement plan participants must begin receiving RMDs is increased from 72 to 73.

- For a plan that starts after December 31, 2022, employers are not required to provide most notices under ERISA or IRS rules to employees who do not participate in the employer’s retirement plan.

- Effective December 29, 2022, employers may allow plan participants to designate employer matching and non-elective contributions as after-tax Roth contributions.

- Hardship distributions from a 401(k) or 403(b) plan can be self-certified.

- Generally, there is a 10% penalty on early withdrawals before age 59 ½ but this is waived for distributions to terminally ill individuals. Physician certification is required.

In closing, if you are an employer or an employee, your HR and/or payroll providers are your best points of contact to navigate how the SECURE Act impacts you. There are credits available to help start-up companies become compliant with the SECURE Act.

I hope you found this article informative. As always, if you would like to schedule a consultation, please reach out.

Resolve to have a purpose-driven 2023.

With gratitude,

Nadine

Nadine Riley, CPA

Founder, Masterpiece Accounting Group

Phone: (212) 966-9301

Email: info@mpagroupllc.com

The Masterpiece Accounting Group web, blogs, and articles are not rendering legal, accounting, or other professional advice. Tax strategies and techniques depend on your specific facts and circumstances. You should implement the information in this newsletter only with the advice of your tax and legal advisors.

{6 minutes to read} Let’s look – strategically and intentionally.

As we look back, consider the wise words from two individuals who share the same first name:

Warren W. Wiersbe, an American clergyman/biblical teacher wrote, “you do not move ahead by constantly looking in a rear-view mirror. The past is a rudder to guide you, not an anchor to drag you. We must learn from the past but not live in the past.”

Warren Buffet, any thoughts on when to look back? “In the business world, the rearview mirror is always clearer than the windshield.”

While we wait for the legislators to meet on common ground considering the tax implications for next year, there are some decisions we can make now that could impact our 2021 tax liabilities.

Key Takeaways:

- Pandemic relief: One that could impact us in 2021 is retirement withdrawals.

- Larger deduction on meals and cash donations.

- Pre-tax payroll deductions – update selections.

- Life-changes decisions, update beneficiaries, consider starting a “will.”

- Roth conversion – if income is low – considering the proposed increase in taxes.

First, let’s look back at the 2020 tax year and review some of the items that may impact us in the current year under the Coronavirus Aid, Relief, and Economic Security Act (CARES). The CARES Act offered numerous reliefs to taxpayers. They benefited us for the 2020 tax year, but some have expired. Nonetheless, some of these income types of relief spillover (or change) in 2021 and could create a costly tax impact. Here are a few:

- Retirement distribution allocation: Did you withdraw money from your retirement savings in 2020 – and choose to allocate your withdrawal(s) over the 3 years? If yes, there are tax implications on the amount allocated for 2021.

- Early withdrawal penalty: In 2020, the early withdrawal penalty was waived, however, if you withdraw retirement funds in 2021, you may be faced with a 10% penalty on the amount – in addition to your other tax liabilities.

- Required Minimum Distribution (RMD): This is an age-required distribution that was also waived for 2020, however in 2021 there’s a requirement to take the RMD which is a taxable event. If you feel a little charitable, you can reduce the tax impact by donating directly to an organization –see below.

- Unemployment income – If you collect unemployment income in 2021, it is taxable under the federal government and some states.

Second, let’s look at some temporary deduction benefits that are still available to us:

- The Consolidated Appropriations Act (2021), known as CAA, was passed by Congress on December 21, 2020, and signed into law on December 27, 2020. The act includes some items that can help reduce our tax liabilities, one of which is the meals deduction.

- Meals – under the CAA, food, and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. In the past, only a 50% deduction was allowed on most meal expenses. Note: It is important to keep itemized receipts in case you are called upon to present them to any of the tax agencies.

- ‘Tis the season for giving: Under the CARES Act, individuals can deduct up to 100% of their AGI (in the past, only up to 60% was allowed) of cash donations made in 2021. Corporations can deduct up to 25% (in the past only 10% was allowed).

Third, here is a shortlist of moves you can still make in 2021 that could reduce your tax liabilities.

- Deferred tax on retirement contributions: if your employer plan allows it, consider contributing the maximum to your savings. The IRS limit is $19,500; if you are fifty and over, the max is $26,000.

- Retirement savings for self-employed: if you have not yet done so, you can set up a retirement plan in 2021 and delay contributing until 2022. Some plans allow this privilege; discuss your options with your financial advisor.

- Investment loss: Do you have a large amount in harvested (accumulated) capital losses? Consider speaking with your financial advisor about capital gains types of investment strategies.

- Savings for education: make your state-affiliated 529 Plan contributions before the end of the year.

On a related note, considering the proposed tax increases, if your income is low in 2021, consider a Roth conversion.

Lastly, don’t forget to make some of these life-changes updates:

- To employees — update your payroll-related withholdings — such as W-4, insurance, 401K, dependent care, HSA/FSA, etc.

- To all — update your beneficiary information with your financial institutions — with the fickleness of human nature — God only knows the unforeseen events that could impact us, financially.

- To all — the “will” — consider consulting an attorney to begin the preparation of a will. You may agree with me, that the current pandemic reminds us how fragile we are – and how little control we have over our own lives. You are welcome to reach out to me for a referral. Choose an attorney who is willing to walk you gently through this process.

As I close, let us choose to look back with intent. If you would like to schedule a tax planning consultation, please don’t hesitate to reach out.

Continue to stay well and safe,

Nadine

Nadine Riley, CPA

Founder, Masterpiece Accounting Group

Phone: (212) 966-9301

Email: info@mpagroupllc.com

The Masterpiece Accounting Group web, blogs, and articles are not rendering legal, accounting, or other professional advice. Tax strategies and techniques depend on your specific facts and circumstances. You should implement the information in this newsletter only with the advice of your tax and legal advisors.

Let’s Welcome the Season of Hope!

Many believe that Thanksgiving Day opens the doors to welcome the “Season of Hope.” There is often a sense of vibrancy in the atmosphere between this day and the end of the year.

Maybe this is partially due to the Christmas lights and the flames from the menorah at Hanukkah. Regardless of your faith or lack thereof, I think you may agree with me that there is some joy from the brightness at this time of year.

Moving along — There’s much we can do before the year ends; I hope to shed some light on what you may already know.

As a result of the 2020 pandemic — a vast number of taxpayers in 2020 are faced with lower taxable income and low tax liability.

This is one of two (2) pandemic-specific articles; in this article, I will discuss tax planning surrounding Roth retirement conversion. In the next article, I will discuss the implications of under-paying taxes.

RETIREMENT SAVINGS: ROTH CONVERSION

A Roth IRA (“Roth”) is a type of retirement savings that allows individuals to withdraw their savings tax-free; it is widely used and often recommended by financial advisors. Roth allows our retirement savings to grow tax-free since contributions are made with after-tax dollars, unlike the traditional IRA retirement savings option that defers the taxes — ie, the tax is due in the future. In summary, with Roth, we pay the taxes now and with Traditional, we pay the taxes later. Before I continue, each option has its benefits from a tax-planning viewpoint; and can be uniquely beneficial to the saver.

Roth conversion in its simplest form consists of moving money from the tax-deferred savings bucket to the taxable savings bucket (in so doing we tell the government to tax us now using the current tax rate and allow our savings to grow tax-free).

Roth conversion can be a great tax-planning strategy in a period of low income and low taxes. For most taxpayers, 2020 is a lower-income year.

So, who are the individuals who are most likely to benefit?

The individuals who are most likely to benefit are taxpayers in a low tax bracket in 2020, and those who may foresee earning much more income in future years.

I discussed conversion from traditional IRA to Roth IRA; that is switching your past contribution from one bucket to the next. New contributions to a Roth may also benefit in a year with low income and a low tax rate.

For self-employed and/or pass-through income earners, consider making a Roth IRA contribution rather than a traditional IRA for 2020 — this may be possible if you generally make your contributions later in the year or before you file your tax returns (note, the account must be set up or open in 2020 in order to delay contribution) — this is common with SEP retirement savers. Please check with your financial advisor to discuss your Roth savings options.

401K Retirement savers – Please check with your employer’s selected administrator to find out if your plan offers you the ability to convert or contribute to a Roth IRA.

Tax implications of Roth Conversions — work with your financial advisor:

•Once you convert, you can’t undo – Roth conversion is permanent.

•Once you convert, the tax bill is due.

•You must leave the traditional IRA account by December 30, 2020, to qualify for the tax conversion.

On a related topic — RMD — taxpayers who are generally required to take a distribution each year (i.e. RMD) can also benefit if one is in a lower tax bracket than in previous years. Consider a withdrawal from your RMD in 2020. Yes, you read that correctly — It is true that, under the CARES Act, no RMD is required in 2020. However, this does not mean you are not allowed to withdraw. If your 2020 income is very low and you are likely to fall in a much lower tax bracket (after the withdrawal), why not consider a withdrawal of the 2020 RMD and pay a lower tax on it, rather than paying a higher tax debt in the future?

So how do I get started?

First, you would need to have a close estimate of your total income for 2020. If your income is from multiple sources you may want to consider using the service of a financial advisor and tax professional to prepare a tax liability projection.

Next, in order to assess your tax rate — you can use the 2020 tax brackets table enclosed to see which tax bracket your income may apply to you — there are still four (4) tax brackets from 10% to 25% with relatively low tax rates. For example, if your taxable income is approx. $40K and $80K (single and MFJ, respectively) your tax rate is as low as 12%.

Please see all tax brackets and status in the enclosed link from Kiplinger, here.

If you want to consider at least one of these options, act on it now. The great King Solomon reminds us that timing is important — In the Good Book, he penned (Proverbs 6:4), “Don’t put it off; do it now! Don’t rest until you do.”

In closing, I hope I was able to shed some light that will allow you to choose the savings option that is better for you. As always, the ultimate decision is yours.

Thank you for reading.

With gratitude,

Nadine.

Nadine Riley, CPA

Founder, Masterpiece Accounting Group

Phone: (212) 966-9301

Email: info@mpagroupllc.com

The Masterpiece Accounting Group web, blogs, and articles are not rendering legal, accounting, or other professional advice. Tax strategies and techniques depend on your specific facts and circumstances. You should implement the information in this newsletter only with the advice of your tax and legal advisors.

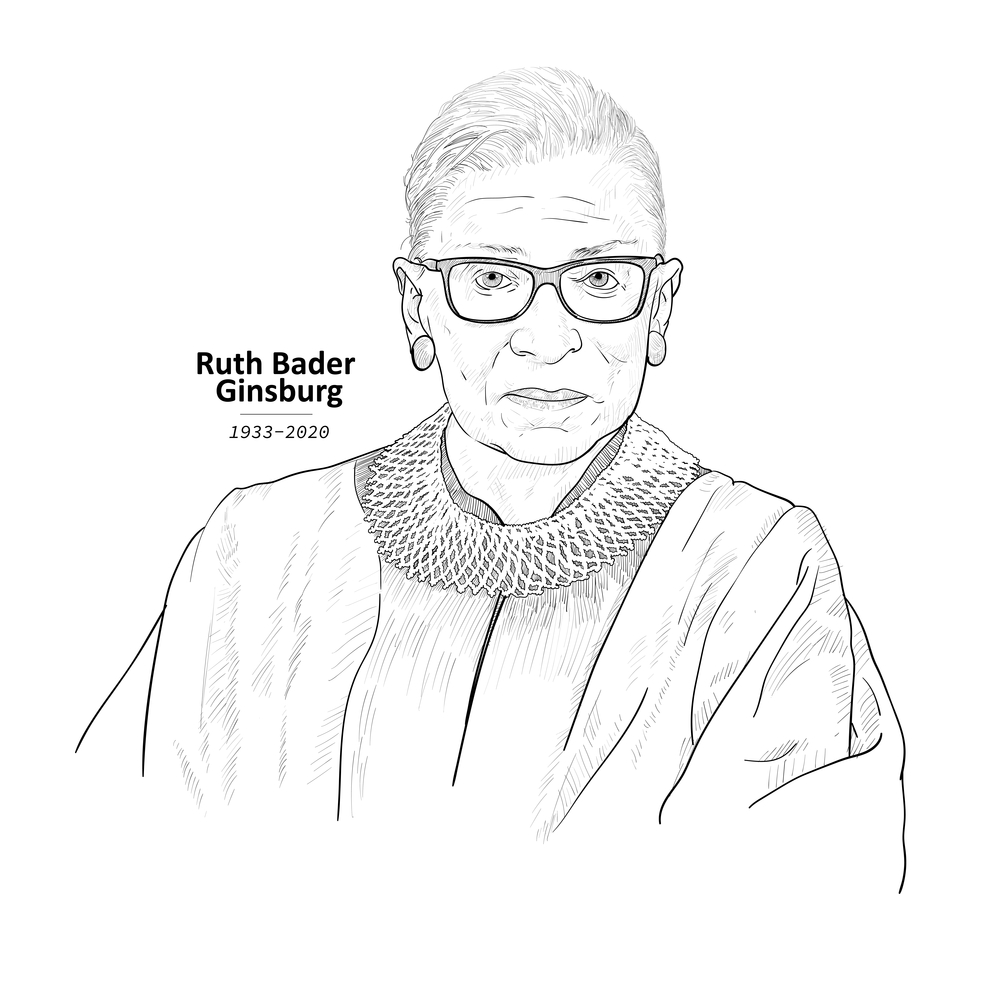

Remembering Ruth Bader Ginsburg

“Don’t be distracted by emotions like anger, envy, resentment.

These just zap energy and waste time.“

(5 Minutes to Read) On Friday, September 18th our fellow Jewish Citizens commenced another new year, Rosh Hashanah. This sacred time is marked with prayer and other ceremonial events. On the said day they also lost one of their (and our) own. Supreme Court Judge Ruth Bader Ginsburg (aka “Notorious RBG”), a woman whose shoulders many of us stand on, fought relentlessly for gender equality.

In all honesty, I didn’t know much about her, but after I learned of her passing I spent a few days watching some of her interviews to learn more about her. Through perseverance and a steadfast commitment from women like Ruth, we have come a long way, haven’t we?

As I reflect on Ruth Bader Ginsburg’s life and legacy, and this sacred time period — I envision a society (a world) of shared responsibility; in which each individual’s sole responsibility is to make a contribution to the better good of mankind as a whole, not just self… Can you visualize that? I can.

Moving along — Taxes

All extensions due to the Covid-19th impact have expired.

In this article, I will discuss the CARES act relief for Coronavirus-related distributions (CRDs).

The next income tax filing due date for C-Corporations and Individuals who filed an extension is October 15, 2020. Please remember to file on time to avoid unnecessary penalties and fines; this penalty is an additional penalty and separates from the failure to pay imposed by the federal and states.

As I continue, I would like to address one of the most frequent inquiries that were made during the pandemic; retirement withdrawals (RMD withdrawals are not required for 2020). Unfortunately, many among us have been furloughed, lost our jobs, or have seen our compensation drastically reduced, so the need to tap into retirement savings may be inevitable.

The coronavirus-related distributions (CRDs) allow for a significant amount to be withdrawn from certain qualified retirement savings, during the calendar year 2020 (i.e. between January 1 and December 31, 2020).

How can this be done wisely?

1.Take advantage of the waiver of the 10% penalty for early withdrawal of up to $100,000 under the CARES Act if you experienced hardship during the pandemic. (Generally, if a withdrawal is made from certain retirement savings before an individual reaches age 59½, a 10% early withdrawal penalty is imposed.)

2. Consider withdrawals for basic necessities only. Withdraw just for what you need; forget the nice-to-haves. There is no waiver of taxes — federal and state taxes will be due on the money taken from retirement.

3. Consider withdrawals from gains that have accumulated over time. While this may not be possible for some individuals, consider withdrawing from the amounts that exceed your contribution. By doing so, withdrawals are made from gains only. This is most likely doable for individuals who have been saving for a long time.

4. No required 20% federal tax withholding is necessary, but consider withholding if you don’t plan to repay or replenish the retirement savings account.

5. Consider taking advantage of the three-year payback period. The CARES act offers an option to pay back funds withdrawn from a qualified retirement plan over a three-year period, and without having the amount recognized as income for tax purposes. This option may be possible if there is a certainty in one’s ability to repay. Furthermore, the full financial impact of COVID-19 still remains a mystery.

6. Other options are available to 401(k) participants (savers). The CARES Act also allows qualified individuals to take a loan from the participant’s vested account balance. You will not owe income tax on the amount borrowed from the 401(k). Please discuss this option directly with your fund administrator.

In closing, a $100,000 withdrawal from savings is a rather hefty amount. Before you act, consider this wise quote penned by Saint Luke as he recapped the words from his Teacher — “don’t begin until you count the cost. For who would begin construction of a building without first calculating the cost to see if there is enough money to finish it?” We are still in a relatively high tax era; and the tax impact will be a factor of your overall income.

As you and I reflect, let’s contemplate our next best move; then resolve to choose wisely. Let’s remember our shared responsibility to each other and contribute to the better good of another. Envision that!

Stay hope-filled and healthy,

Nadine

Nadine Riley, CPA

Founder, Masterpiece Accounting Group

Phone: (212) 966-9301

Email: info@mpagroupllc.com