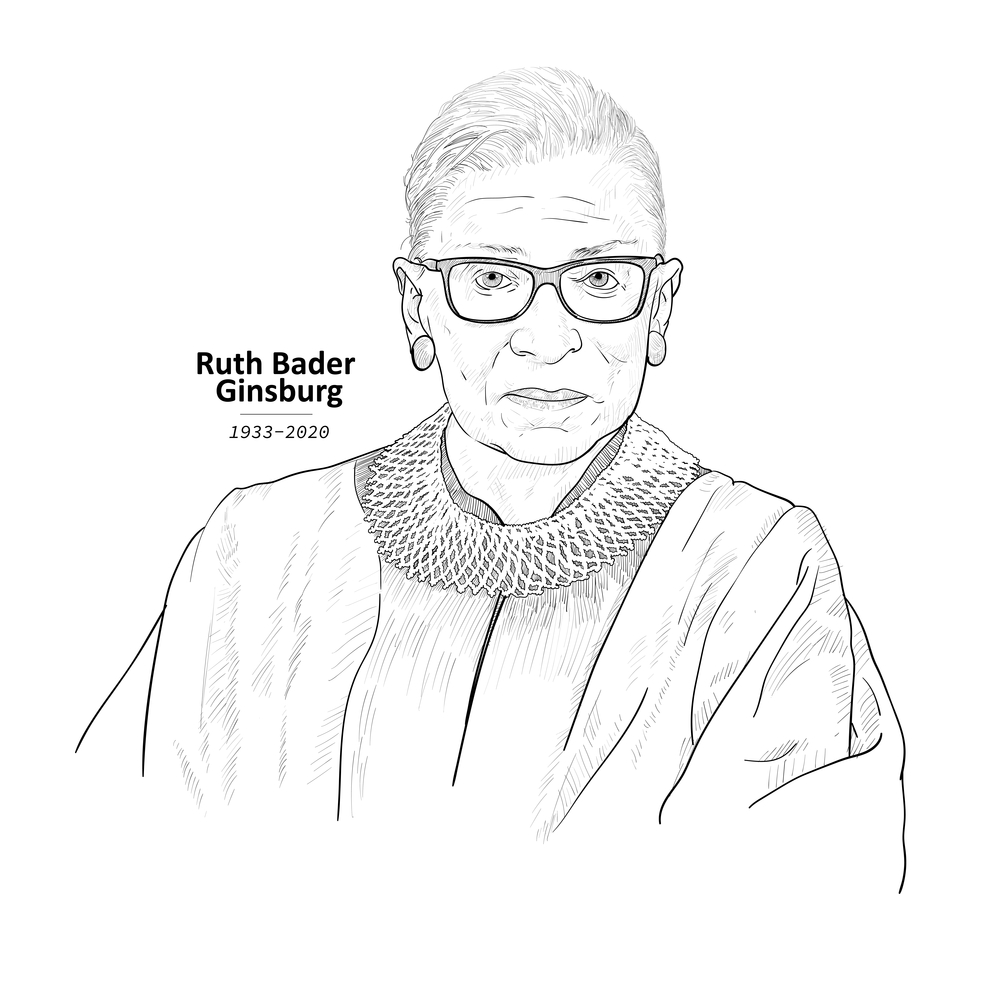

Remembering Ruth Bader Ginsburg

Remembering Ruth Bader Ginsburg

“Don’t be distracted by emotions like anger, envy, resentment.

These just zap energy and waste time.“

(5 Minutes to Read) On Friday, September 18th our fellow Jewish Citizens commenced another new year, Rosh Hashanah. This sacred time is marked with prayer and other ceremonial events. On the said day they also lost one of their (and our) own. Supreme Court Judge Ruth Bader Ginsburg (aka “Notorious RBG”), a woman whose shoulders many of us stand on, fought relentlessly for gender equality.

In all honesty, I didn’t know much about her, but after I learned of her passing I spent a few days watching some of her interviews to learn more about her. Through perseverance and a steadfast commitment from women like Ruth, we have come a long way, haven’t we?

As I reflect on Ruth Bader Ginsburg’s life and legacy, and this sacred time period — I envision a society (a world) of shared responsibility; in which each individual’s sole responsibility is to make a contribution to the better good of mankind as a whole, not just self… Can you visualize that? I can.

Moving along — Taxes

All extensions due to the Covid-19th impact have expired.

In this article, I will discuss the CARES act relief for Coronavirus-related distributions (CRDs).

The next income tax filing due date for C-Corporations and Individuals who filed an extension is October 15, 2020. Please remember to file on time to avoid unnecessary penalties and fines; this penalty is an additional penalty and separates from the failure to pay imposed by the federal and states.

As I continue, I would like to address one of the most frequent inquiries that were made during the pandemic; retirement withdrawals (RMD withdrawals are not required for 2020). Unfortunately, many among us have been furloughed, lost our jobs, or have seen our compensation drastically reduced, so the need to tap into retirement savings may be inevitable.

The coronavirus-related distributions (CRDs) allow for a significant amount to be withdrawn from certain qualified retirement savings, during the calendar year 2020 (i.e. between January 1 and December 31, 2020).

How can this be done wisely?

1.Take advantage of the waiver of the 10% penalty for early withdrawal of up to $100,000 under the CARES Act if you experienced hardship during the pandemic. (Generally, if a withdrawal is made from certain retirement savings before an individual reaches age 59½, a 10% early withdrawal penalty is imposed.)

2. Consider withdrawals for basic necessities only. Withdraw just for what you need; forget the nice-to-haves. There is no waiver of taxes — federal and state taxes will be due on the money taken from retirement.

3. Consider withdrawals from gains that have accumulated over time. While this may not be possible for some individuals, consider withdrawing from the amounts that exceed your contribution. By doing so, withdrawals are made from gains only. This is most likely doable for individuals who have been saving for a long time.

4. No required 20% federal tax withholding is necessary, but consider withholding if you don’t plan to repay or replenish the retirement savings account.

5. Consider taking advantage of the three-year payback period. The CARES act offers an option to pay back funds withdrawn from a qualified retirement plan over a three-year period, and without having the amount recognized as income for tax purposes. This option may be possible if there is a certainty in one’s ability to repay. Furthermore, the full financial impact of COVID-19 still remains a mystery.

6. Other options are available to 401(k) participants (savers). The CARES Act also allows qualified individuals to take a loan from the participant’s vested account balance. You will not owe income tax on the amount borrowed from the 401(k). Please discuss this option directly with your fund administrator.

In closing, a $100,000 withdrawal from savings is a rather hefty amount. Before you act, consider this wise quote penned by Saint Luke as he recapped the words from his Teacher — “don’t begin until you count the cost. For who would begin construction of a building without first calculating the cost to see if there is enough money to finish it?” We are still in a relatively high tax era; and the tax impact will be a factor of your overall income.

As you and I reflect, let’s contemplate our next best move; then resolve to choose wisely. Let’s remember our shared responsibility to each other and contribute to the better good of another. Envision that!

Stay hope-filled and healthy,

Nadine

Nadine Riley, CPA

Founder, Masterpiece Accounting Group

Phone: (212) 966-9301

Email: info@mpagroupllc.com